In the chaos of central Mumbai바카라ôs Bhendi Bazar, the Haji Ismail Habib Musafirkhana building, covered in black tarpaulin and bamboo scaffolding, stands in quiet ruin. In the late 19th century, the building was a celebrated resting place for travellers and Hajj pilgrims. By the 1990s, it gained notoriety as the residence of underworld don and India바카라ôs most wanted terrorist, Dawood Ibrahim, whose family lived in two rooms on the top floor. The weathered structure now stands mired in a heated legal battle over ownership and redevelopment.

Contested claims on Musafirkhana as a waqf or non-waqf property have become a major stumbling block in the Rs 4,000 crore Bhendi Bazaar Redevelopment Project바카라Ēthe ambitious plan to transform the Muslim ghetto into a modern, upscale neighbourhood. Representatives of the Musafirkhana Trust have claimed that the property is waqf and has an established mosque where namaaz has been offered since time immemorial, whereas the Dawoodi Bohra community바카라ôs Saifee Burhani Upliftment Trust (SBUT), undertaking the redevelopment, has argued that the building only had a prayer hall and not a mosque.

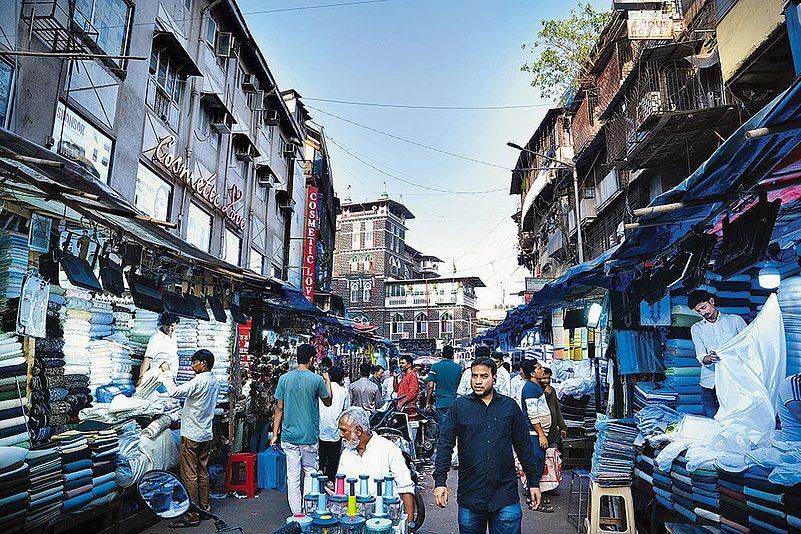

The redevelopment project spanning 16.5 acres with over 250 buildings, 3,200 families, and 1,250 shops is one of the largest urban renewal efforts in the country.

On April 8, just days after the Parliament passed the Waqf (Amendment) Bill, 2025, the Maharashtra State Waqf Tribunal passed a legal order declaring Musafirkhana a non-waqf institution, clearing the way for the building바카라ôs demolition and development.

바카라úThe Waqf Board has not been transparent in its decision to declare Musafirkhana as non-waqf, as the procedure investigating its historical records as waqf property was ongoing. We have got a stay order from the Waqf Tribunal until further notice,바카라Ě say advocate Yusuf Baugwala and his wife Sana Baugwala, who filed a case in the High Court against its redevelopment.

The latest decision, Baugwala alleges, overturns the Supreme Court바카라ôs 2022 decision in the Musafirkhana case, stating that under the ambit of Islamic laws, no documentation is required to declare a property as waqf. 바카라úThe Central government바카라ôs amendment in the Waqf Bill to remove the concept of waqf by user also reinforces the Maharashtra Waqf Board바카라ôs decision on Musafirkhana,바카라Ě he says.

Extremely concerned about the decision on Musafirkhana, the state바카라ôs Muslim community has joined forces to form a 바카라ė바카라ėWaqf Task Force바카라ô바카라ô to protect the historic structure바카라ôs identity.

The SBUT acquired the Musafirkhana in 2016 as part of the major cluster redevelopment of Bhendi Bazar. Seventeen other waqf supporting properties were also purchased and demolished. However, the redevelopment of the Musafirkhana building became contentious after some members of the Musafirkhana Trust opposed its sale and demolition, arguing that the structure houses a mosque and a prayer hall, and it cannot be repurposed for non-religious use.

바카라úOnce a waqf, always a waqf. We don바카라ôt know how the Waqf Board made this decision,바카라Ě says Amin Patel, Congress MLA from Mumbadevi constituency, where Musafirkhana is located. He adds that because there was a mosque in the building where many people have been praying for years, the waqf status of the property cannot be changed for non-waqf use. 바카라úPeople바카라ôs sentiments are attached to this property due to religious reasons. Some tenants are desperately pushing for redevelopment as the building is in a dilapidated condition. This is a matter of faith and cannot be amicably solved by a court order,바카라Ě says Patel.

The Musafirkhana case has become a glaring example of how waqf properties in mumbai바카라ôs prime real-estate could meet their fate, Muslim community leaders say.

The Musafirkhana case has become a glaring example of how waqf properties located in the prime real-estate of Mumbai could meet their fate, Muslim community leaders say. 바카라úThe new law does not favour Muslims at all. Instead, it has made it easy for the government to declare waqf land as non-waqf, which real-estate developers will no doubt take advantage of as they have been eyeing many properties in prime locations,바카라Ě says Salim Mulla, President of the Waqf Action Task Force.

Maharashtra has an estimated 36,701 Waqf properties covering approximately 93,418 acres of land. Unlike other parts in the state, where waqf properties are on open land and undeveloped, in Mumbai, a large chunk of waqf properties is in the form of buildings, says Shoaib Khatib, trustee of the Juma Masjid in Mumbadevi, who also intervened in the Musafirkhana case to protect the mosque from demolition.

바카라úEvery mosque in Mumbai typically owns several additional buildings, which are leased out for residential and commercial use, to help cover the operational and maintenance expenses of the mosque. Religious waqf properties like mosque, dargah and kabristan cannot be redeveloped for any other use except for the original purpose of endowment. Waqf properties which are used for non-religious purposes can be developed under conditions,바카라Ě he says.

Among the new changes to the waqf law, community leaders voice apprehensions over key provisions, like the elimination of Section 40 of the Waqf Act, 1995, which empowered waqf boards to investigate and determine whether a property was waqf. Delegating powers to district collectors to identify any waqf property as non-waqf or government land till a court determines its status. Nomination of members of the State Waqf Board, instead of election, and inclusion of non-Muslim members, further reducing community control over its own religious endowments.

The inclusion of the Limitation Act of 1963 in the amended Waqf Act, which imposes a 12-year limitation period for filing suits related to immovable property, has also been objected to as highly problematic. It could lead to permanent loss of encroached or disputed properties in possession of encroachers for over 12 years. Majority of waqf land바카라Ēaround 70,000 acres바카라Ēis reportedly under illegal occupation바카라Ēeither by land mafias or by various government offices and departments.

The dargah of Sufi saint Lal Shah Baba in Lalbaug is a controversial waqf case.

Muslim leaders across communities바카라Ēincluding Sunnis, Shias, Khojas, Memons, Bohras, and others바카라Ēfear that the new provisions stand to take the control and decision-making power from their hands and pass it to the government, which will decide the ownership and status of waqf properties. As a result, the community risks losing several disputed properties, waqf-by-user lands lacking proper documentation, and long-standing encroached properties. At stake is nearly 30 per cent of waqf properties in Maharashtra that lack adequate documentation, while many others are dually registered with both the Waqf Board and the Charity Commissioner바카라Ēleading to legal disputes and contestation claims from other parties.

Prior to the establishment of the Waqf Board in Maharashtra in 2002, the Charity Commissioner under the Bombay Public Trusts Act, 1950 (BPT Act), governed and maintained records of all public religious and charitable trusts and their immovable land assets, including registration of properties and administration of the Hindu-owned mutts and waqf properties of Muslims. The transfer of hard copies of these land ownership records from the Commissioner to the Waqf Board in the pre-digital era resulted in errors and duplications in the registration of several properties.

바카라úSeveral trusts have misused the processes to illegally sell large parcels of prime waqf land. The BPT allows the sale of land parcels for the development of the trust, but waqf property generally cannot be sold or alienated from its endowments,바카라Ě says Mulla.

In 2015, the state government appointed ATAK Shaikh Commission investigated 114 complaints related to waqf land in Mumbai and Maharashtra. It found serious issues of illegal transfers, unauthorised sales, and widespread mismanagement within the Waqf Board. Since many waqf properties are poorly maintained and lack updated documentation, members of religious and charitable Muslim trusts바카라Ēoften in collusion with the State Waqf Board바카라Ēexploited loopholes to illegally sell or convert long term leases of waqf land into ownership for commercial gains, community members says.

After Mumbai바카라ôs real-estate began to boom in the 2000s, following the sale of large tracts of mill lands in South and Central Mumbai, religious and charitable trusts holding waqf properties suddenly found themselves sitting on prime properties worth crores in central locations like Byculla, Lalbaug and Dongri. Many were pressured by developers and the industrialists바카라ô lobby to part with their lands.

Industrialist Mukesh Ambani바카라ôs 27-storey Antilia residence at Malabar Hill was flagged by the ATAQ Shaikh Commission as a case of illegal sale of waqf land. Originally earmarked for the construction of an orphanage, the land measuring 48,768 sq ft was sold to Ambani바카라ôs Antilia Commercial (P) Ltd for a price of Rs 21.05 crores, without the mandatory two-thirds majority approval from the Waqf Board. The sale was formally challenged by the Congress바카라ô former Waqf Minister Anees Ahmad, who raised the issue before the Commission.

The dargah of Sufi saint Lal Shah Baba in Lalbaug is a controversial waqf case. The historic 17th-century mausoleum is now overshadowed by an under-construction residential tower. The Dargah Trust claims that part of its waqf properties in Lalbaug were illegally acquired and developed by a major real-estate developer. In Mazgaon, another historic structure, the Prince Aly Khan Hospital, has been razed to make way for a posh residential complex called the Aga Hall Estate. The Hospital Trust stands accused of altering the charitable status of the waqf-endowed property and repurposing it into a commercial real-estate project. These properties attracted controversy largely due to corruption within the State Waqf Board and the state government, which overlooked the irregularities, claims Shabbir Ahmed Ansari, President of the All India Muslim OBC Organisation. 바카라úBetween 2007 and 2011, the Waqf Board only had two members, who illegally sold nearly 73 prime properties in Mumbai at throwaway prices. We demanded the state government to take action against them and cancel these deals, but there was no action,바카라Ě he says. Ansari laments that the amended Waqf law would end up legitimising these unauthorised deals. The ATAK Shaikh Commission, he notes, held the district collectorate authorities largely responsible for the irregularities as their approval is final in land transactions. 바카라úUnder the new waqf provisions, the Collector has been designated as the final authority in determining the ownership of waqf land바카라Ēeffectively placing control in the hands of the very authority that has caused the most damage to these properties,바카라Ě he says.

Baugwala바카라Ēwho has filed many legal interventions in the recent past to free illegally occupied and encroached waqf properties바카라Ēnotes that the Waqf Act was originally enacted to safeguard the interests of Muslims, similar to the special legal provisions for minorities such as Parsis and Jains, which ensure continuity and protection of ownership over their religious and community properties.

He says, 바카라úLike in the case of the Musafirkhana building, the government is attempting to end the title of waqf properties. Once such properties go for redevelopment, the ownership will no longer be in the possession of the Waqf Board. They won바카라ôt belong to the Muslims.바카라Ě

Shweta Desai is a senior editor based in Mumbai and reports on politics, conflicts, human rights, culture and gender